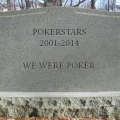

Liquidity Sharing No Savior as Online Poker in New Jersey Continues to Disappoint

Online poker in New Jersey doesn’t seem to be benefitting from the state’s liquidity sharing pact with Nevada and Delaware according to the latest financial report.

Liquidity sharing isn’t solving New Jersey’s online poker slump according to the latest financial report. (Image: Carbontracker.org)

Released by the New Jersey Division of Gaming Enforcement (NJDGE) on September 12, the August overview shows a 12.8 percent drop in online poker revenue. Comparing like-for-like, August 2017 saw operators rake $2,082,360 compared to $1,815,820 this year.

The latest drop means that 2018’s year-to-date revenue for online poker has dropped by 11.2 percent to $13,803,359. In contrast, online casino revenue to August 2018 is up by 19.7 percent to $175,438,867.

Poker Can’t Close the Gap

The disparity between online poker and other virtual betting options has been apparent ever since New Jersey authorized internet gaming in 2013. However, when the long-discussed liquidity sharing pact between New Jersey, Nevada and Delaware went live in May 2018, many thought the gap would close.

So far, that hasn’t been the case. Being the largest state both in terms of residents and online gaming, New Jersey was always going to be giving away more than it was getting back.

Although unconfirmed, it has been suggested that this was one of the main sticking points in the negotiation process. Those fears appear to be coming true as the Garden State has failed to see an uptick in business since sharing players across state lines.

The one saving grace for the NJDGE is that only WSOP.com/888poker have connected the proverbial dots. What’s more, the pact should be a long-term investment as it will likely incorporate more states as regulation spreads across the country.

PASPA May Save the Day

Although there is no way of telling when online poker may spread to other regions, the advent of regulated sports betting should expediate the process. Since June 14, 2018, New Jersey’s offline and online sportsbooks have banked $16.5 million, showing that regulating this sector can be lucrative.

Indeed, when the Supreme Court overturned the Professional and Amateur Sports Protection Act (PASPA) in May 2018, a number of states have looked to New Jersey for inspiration. By showing that regulated sports betting is not only possible but profitable, the Garden State is opening up new doors across the US.

With local budgets stretched, sports betting can offer a new source of tax revenue. If that’s possible, regulating other forms of betting, including poker, will also be seen as viable ways to generate income.

However, until other states change their position, online poker in New Jersey will continue to struggle even with its current liquidity sharing pact.

0 Comments