Macau Government Fires Back at Steve Wynn and Casino Industry

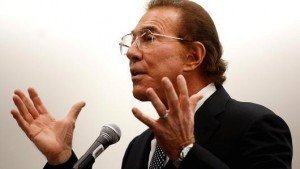

Steve Wynn took the first shot, but the Macau government fired back quickly regarding its caps on table games at casinos in the Chinese gambling mecca. (Image: ggrasia.com)

Macau government officials robustly responded to Steve Wynn this week following critical comments the casino billionaire made about the Chinese territory’s gambling regulations.

During a recent conference call with investors, Wynn reportedly scolded the Macau government for imposing what he called “outrageous and ridiculous” rules regarding the number of gaming tables a resort can offer. Wynn is currently building his second destination in Macau, the Wynn Palace on the Cotai Strip.

“In my 45 years of experience, I’ve never seen anything like this before,” Wynn said.

On Sunday, Macau authorities summoned gambling representatives including Wynn Macau President Gamal Aziz for a meeting in which the lawmakers stressed that no changes would be coming and that it “regretted” certain opinions made by individual casino owners.

Don’t Mess with Macau

As high rollers sailed in on VIP junkets during recent years, casinos have slowly eradicated slot machines from gambling floors in favor of adding additional baccarat, blackjack, poker, and other popular tables to accommodate the millionaires. More than 1,000 tables have been added in the last five years in Macau while thousands of slots have disappeared.

Macau’s new “table cap” policy seeks to limit live dealer growth to “three percent compound annual expansion until end-2022.” The provision makes it rather difficult for new resorts to estimate how many tables its floor will be allocated.

That doesn’t sit well with Wynn who is spending more than $2 billion on his new venue. “The single most counterintuitive and irrational decision that was ever made,” Wynn told his shareholders.

Though politicians are sometimes easily bought or at the very least influenced in the United States, Macau is standing firm in front of one of gambling’s most influential figures.

Stocks Tumble, Investors Optimistic

Macau might be capping table games, but there’s no cap on how low the region’s gambling stocks can fall. Combined with China’s crackdown on junket operators catering to the ultra-wealthy and their alleged tactics to move money outside of the mainland government’s reach, the gambling mecca is experiencing an unprecedented crash.

Gaming revenue for the city has fallen for 16 straight months and Wynn Macau Ltd. has lost more than 60 percent of its value over the last year. But investors see the market as a buying opportunity.

Analysts have turned bullish on Macau stocks due to speculation that the Chinese government will take steps to boost the territory’s economy in the coming months.

“There’s been a sudden re-assessment of the sector,” Okasan Securities Group strategist Mari Oshidari told Bloomberg. “Shares are probably headed for a short-term rebound.”

Support from the mainland won’t likely have a great enough impact to reverse Macau’s decaying economy unless President Xi Jinping and the People’s Republic loosens its restrictions on VIP junkets.

VIP players accounted for 60 percent of revenues in 2014, meaning casinos will need to look to new audiences, should junket regulations continue.

“Any potential measures to help Macau’s visitation could be a great boom,” JPMorgan Chase analyst DS Kim said earlier this month. “Casual gamblers are now becoming the key pillar of the industry profits in the midst of VIP weakness.”

0 Comments