Amaya Could Reengage with GVC Following 888 Bailout on Bwin.party Deal

Will Amaya CEO David Baazov make a bid now that 888 has stepped aside? GVC CEO Kenny Alexander has dropped hints that partypoker could be up for sale, and Amaya might be waiting in the wings with a scooper. (Image: sbcnews.co.uk)

Amaya is somewhat akin to the fat lady singing in the famous aphorism. The online poker giant could be hitting a high C in the last act of a protracted bidding war that finally came to a denouement last week.

That bidding war, between 888 Holdings and GVC Holdings, officially wrapped up this week after the former issued a statement regarding its position on bwin.party.

Despite being given the green light by bwin.party back in July, 888 was subsequently beaten by a better offer from GVC last week. This last-minute move eventually secured GVC the takeover, and the two companies will now begin a merger that should be completed by the close of 2015.

Following the announcement of a deal, 888 explained that it will no longer seek to take control of bwin.party.

“The 888 board has concluded that, as a result of its own extensive due diligence on bwin.party, it cannot see sufficient value in bwin.party to warrant a revision to its offer,” read the statement.

Fun Has Just Begun

However, despite it looking as though the opera is over, it could be just the start of the corporate fun if Amaya decides to enter the mix.

As news broke that GVC’s bid had been accepted, GPI owner Alex Dreyfus began to speculate that Amaya could make a play for partypoker.

Read : @Amayaonline to acquire @partypoker @partypokerUS in Q1 2016. https://t.co/k3sTRDQyiF

— Alexandre Dreyfus (@alex_dreyfus) September 4, 2015

On top of this, GVC CEO Kenny Alexander explained that his company’s strategy going forward is to streamline bwin.party and make it a more efficient entity. One of the ways in which it plans to do this is by assessing sensible offers for various bwin.party assets, one of which is partypoker.

Traditionally, GVC’s expertise is in the sports betting market (it’s the owner of Sportingbet) and it’s been well documented that it considers poker the least profitable part of the bwin.party platform. This attitude, combined with previous interest in bwin.party from Amaya (it was part of a joint bid for the company with GVC), could lead to the sale of partypoker.

Amaya to Leverage Poker Position

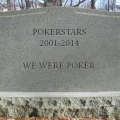

Before Amaya took control of the Oldford Group, the parent company of both PokerStars and Full Tilt, it didn’t have much of stake in the online poker community. However, since that time it’s become the largest player in the market, and will no doubt seize any opportunity to own a larger stake in the industry.

One of the primary motivators for Amaya could be the presence of partypoker in the US regulated market. Partypoker has a major presence in New Jersey, thanks to its poker network on which its own branded site, as well as the Borgata’s, currently operates.

If Amaya could take control of partypoker, then it would give the company a strong footing within the market and potentially give it a way to leverage a position with US legislators. That’s a position which could then be used to expedite PokerStars’ return to the US, in theory anyway.

For players, however, Amaya taking control of partypoker could have a negative impact on the industry as a whole.

By owning three of the largest online poker brands in the world, Amaya would have a virtual monopoly on the market, which could lead to a decline in promotions and distinctions between the platforms.

0 Comments